Outsourcing Accounts Payable Services

Having that ‘I’ll just do it myself’ mentality is something that we’re all guilty of, and sometimes it works to our advantage, and sometimes it doesn’t. An accounting service that provides AP automation can make or break the success of your company’s accounts payable process. Although Outsourcing Accounts Payable Services may not be for everyone, it is definitely worth considering.

Overview of Outsourcing Accounts Payable Services

Accounts payable refers to the money owed to vendors or suppliers. A company purchases items on credit, which is then repaid over a specific period of time – essentially, it’s an IOU.

A company’s accounts payable department is crucial to keeping its finances in check and maintaining healthy relationships with suppliers. A company’s accounts payable workflow goes beyond recording invoices and paying them. It includes invoice processing, POs, data entry, and more. Increasing cash flow and saving money can be achieved by optimizing accounts payable processes.

How Do Accounts Payable Outsourcing Work?

In accounting payable outsourcing, you hire a third party to handle your company’s AP processes. But AP outsourcing does not, and shouldn’t, stop there. BPO providers provide all the tools and technology required to carry out all of your business’s accounts payable functions. In order to enable growth, top-notch providers will not just handle these tasks but will optimize them through the introduction of new capabilities and the development of more efficient business processes.

In-house Accounts Payable Challenges

The accounts payable department that manages the AP process on its own (in-house) is probably overwhelmed, especially if you’re a small business.

In line with Ardent Partners’ Accounts Payable Metrics that Matter in 2020, the main obstacles hindering AP progress include exceptions, lengthy invoice approval times, and an excess of paper. Along with these concerns, the significant amount of time dedicated to managing supplier inquiries is also a major hurdle. Without addressing these operational and labor-intensive concerns, companies cannot maximize the potential of their AP divisions. As a result, reducing processing expenses, streamlining workflow, optimizing back-office operations, and making well-informed choices become increasingly difficult to achieve.

Outsourcing Accounts Payable Has Many Benefits

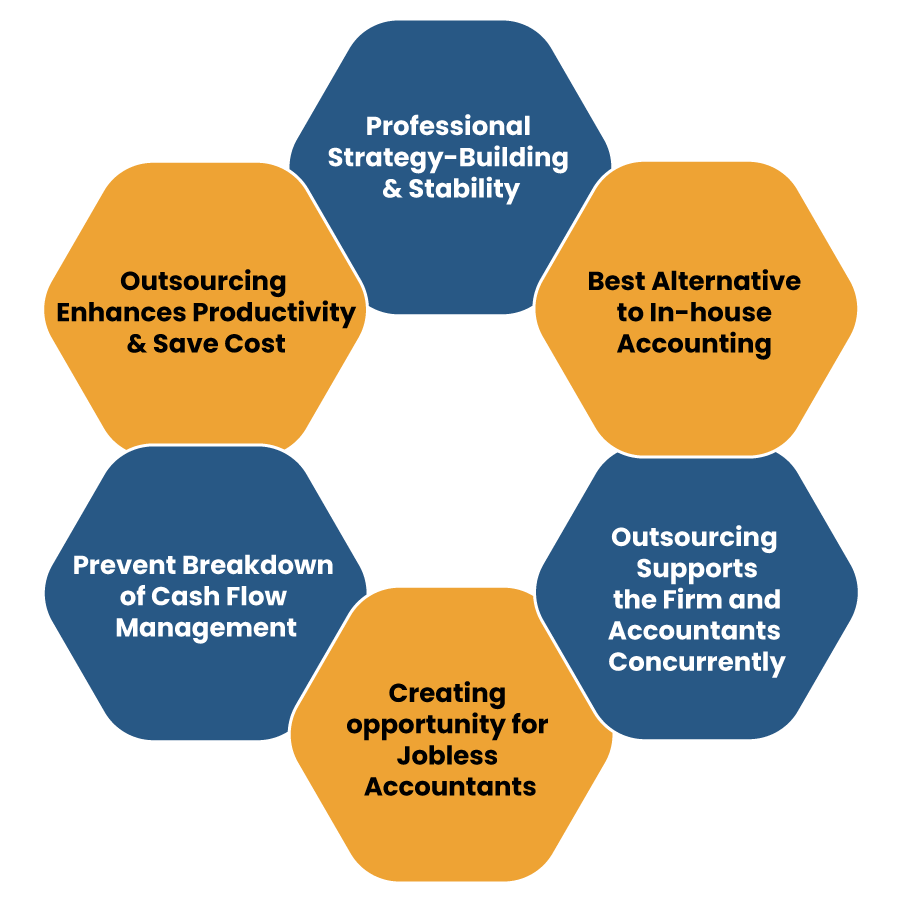

Outsourcing accounts payable to a trusted partner may seem daunting, but it offers tons of benefits:

- Time and money saved

- New tools and solutions for payables

- Workflow improvement

- A higher level of security

Companies can boost revenue, streamline their operations, and improve their processes with the right provider. In addition to improving cash flow and making the AP process more efficient, established accounts payable software services will also lower costs and build stronger relationships with vendors and within the company.

Outsourcing Vs. Automation Of Accounts Payable

If your Accounts Payable operations aren’t cutting it, you may wonder whether to automate or Outsourcing the process.

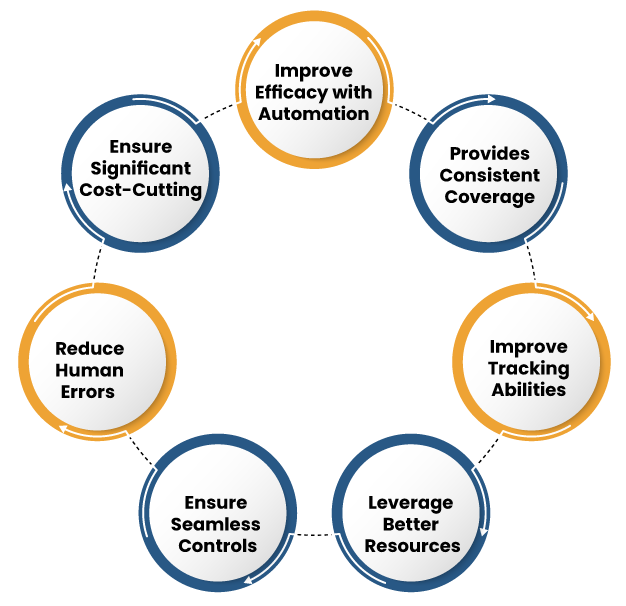

By implementing AP automation, the entire invoice processing process is streamlined. This includes tasks such as receiving invoices, routing them for approval, matching them with POs and receipts, managing exceptions, and ultimately approving them for payment. Overall, it ensures that each invoice is easily accessible, monitored, and paid promptly. Incorporating third-party software enables companies to automate their accounts payable procedures while keeping all operations in-house and providing necessary training for AP staff members.

Using an external provider to manage all of your AP operations is a bit different from outsourcing your AP. This avoids the cost of adopting accounts payable software and does not use company resources to manage the process. In addition, it provides a business with a wide range of technology and tools – including AP automation – that help it stand out from the competition.

Outsourcing Accounts Payable Has Many Advantages

Outsourcing accounts payable Servcies provides a unique opportunity to completely revamp the AP process while also saving time and money.

- Savings

Outsourcing your AP process is cheaper than other solutions, which is the truth. The third-party provider already has the people and tools to streamline the AP process for you, so you don’t have to hire staff and train them. As a result of these cost reductions, the company’s cash flow improves and its financial health improves.

- Automation and resources

AP service providers already possess software, document management, and reporting tools needed to manage Outsourcing accounts payable. AP automation can and should be included in this package, which unlocks value in various accounts payable processes, such as invoice processing, ERP integration, and payment and remittance management.

- Reducing the use of paper invoices and manual data entry

Accounts payable outsourcing offers the opportunity to eliminate paper and eliminate manual work such as data entry. No more drowning in paper invoices and no more wasting resources that could be spent more strategically.

- Process invoices securely

A growing number of small and medium-sized businesses are plagued by security issues because the world is becoming increasingly complex and sending payments to vendors has become increasingly complicated. By providing sophisticated security measures and technology for AP processes, AP outsourcing providers help companies reduce their chances of experiencing payment fraud.

- Turnaround times that are faster

Using a payable outsourcing service that has access to the latest technology and time-saving tools can help you get more done in a shorter amount of time. Additionally, it creates a fast and accurate accounting system, which streamlines a company’s processes.

- Error-free

Manual data entry and the lack of control around Purchase Order requisitions, approvals, and deliveries accounts for many accounts payable errors.

A professional Outsourcing company will utilize advanced technologies, systems, and processes to identify, eliminate, and mitigate errors.

Outsourcing Accounts Payable Has Its Cons

Outsourcing the AP process to a third party comes with some hesitations, so moving your in-house AP department to a third-party provider is not a decision you should take lightly.

- Concerns about privacy and third parties

In order to outsource accounts payable, a company must give away its historical data as well as any internal documents, something some might be concerned about. In order to make sure a provider meets your privacy requirements, it’s always a good idea to research their privacy policies and security measures before engaging with them.

If this concerns you, suggest researching the outsourcing partner’s privacy policies and security measures before engaging them.

- Accounts payable are not controlled

When a company Outsourcings account payable, it loses control over its entire account payable process. It’s no longer possible for them to ‘pop in’ to check on bookkeeping and see how things are going. While remote work is becoming increasingly popular, it’s worth clarifying with a potential provider that transparency and open communication are important to you if the loss of control is a big concern.

- Problems with teething

When outsourcing the account payable process, there might be some initial challenges. When converting from an in-house department to an Outsourcing department, duplicate entries are possible. It would be a good idea to hold an internal meeting with staff before any changes take place to discuss the outsourcing partner, how this will affect workflow, and what employees can do to ensure a smooth transition.

Here Are Some Tips To Help You Shift From In-house To Outsourcing Accounts Payable

In order to make the move from in-house account payable to outsourcing accounts payable Servcies, companies must conduct due diligence on any potential account payable outsourcing firms. Here are some tips to ensure your selection is the right fit:

- The research:

Get your hands on any testimonials and case studies, which will give you a glimpse into the experiences that other businesses had with the particular provider. Be sure the provider’s security policies align with yours. Also, take a look at what worked for those companies and what didn’t.

- Get ready by:

As soon as a company Outsourcings its account payable tasks, everyone needs to be on the same page. Roles and responsibilities can change, and employees should be made aware of this and educated about what the Outsourcing company is taking over. Any changes in processes like data entry should also be communicated to prevent duplications and errors.

- The monitor is:

An outsourcing firm’s productivity can be monitored with a performance monitoring tool. It includes features such as timesheet reports, inactivity timers, detailed project reports, and more.

If You Do Not Outsourcing Your Accounts Payable, You Will Face Future Challenges

Businesses are increasingly outsourcing the account payable function because they realize they can improve operations without investing in technology internally. If you don’t outsource accounts payables, you’re missing out on reduced costs, better cash flow and workflow, better vendor relationships, and peace of mind that your AP processes are being managed with the latest technology.

Account payable operations that are manual, time-consuming, prone to errors, and lack visibility won’t enable future growth and will only lead to more challenges in the future. In the current business environment, outsourcing accounts payable Services removes these challenges and positions a company to compete and thrive.

Accounts payable outsourcing from Booksdr.

Account payable outsourcing isn’t just about handing over a company’s account payable tasks and being done with it. Leading outsourcing providers like Booksdr elevate the account payable process with industry experts and state-of-the-art technology.

Booksdr wide range of product solutions, such as accounts payable outsourcing, invoice processing, and accounts receivable, make us an essential part of any company’s success. Booksdr works with businesses to improve cash flow and improve operational efficiency by focusing relentlessly on the customer.