Receivables outsourcing is a business practice in which a company hires a third-party vendor or partner to manage some or all of its accounts receivable functions. This outsourcing company can handle tasks such as invoicing customers, tracking payments, tracking outstanding invoices and customer credit checks, and more.

Receivables outsourcing is a business practice in which a company hires a third-party vendor or partner to manage some or all of its accounts receivable functions. This outsourcing company can handle tasks such as invoicing customers, tracking payments, tracking outstanding invoices and customer credit checks, and more.

By outsourcing these tasks, companies can free up valuable time and resources for other core activities or focus on complex A/R issues that are best handled in-house. Ideally, outsourcing helps businesses reduce their overhead costs by not having to hire and train their own staff to handle important accounts receivable processes. Much of the benefit will depend on the quality of that A/R partner, but if handled correctly by an experienced third party, this practice can pay off big for businesses.

Accounts receivable outsourcing can also lead to different benefits and stronger business results, depending on what services are outsourced. It is common for companies to question the benefits of outsourced payments; as a critical financial process, isn’t it better to maintain control by keeping things internal? Not necessarily. Although outsourcing is seen as synonymous with loss of control, it is important to understand the benefits of accounting outsourcing and how businesses can benefit from partnering with a service provider that has the expertise to help businesses collect payments more efficiently:

Companies that specialize in outsourced A/R functions have the knowledge, skills, and experience to effectively manage the process. They have dedicated staff trained to handle accounts receivable, which can lead to better workflow, less waste, and faster collection.

While outsourcing A/R comes with upfront costs, outsourcing these processes can be more cost-effective than hiring and training your own team. Outsourcers offer economies of scale, meaning they can provide services at lower costs due to their size and resources.

By outsourcing accounts receivable Services, businesses can speed up the invoicing and payment process. This can help improve cash flow and help companies more easily meet their A/R goals in terms of average collection time, days sold (DSO), A/R turnover ratio, and more.

By outsourcing accounts receivable, companies can free up time and resources for other business activities, such as revenue activities or other customer management tasks.

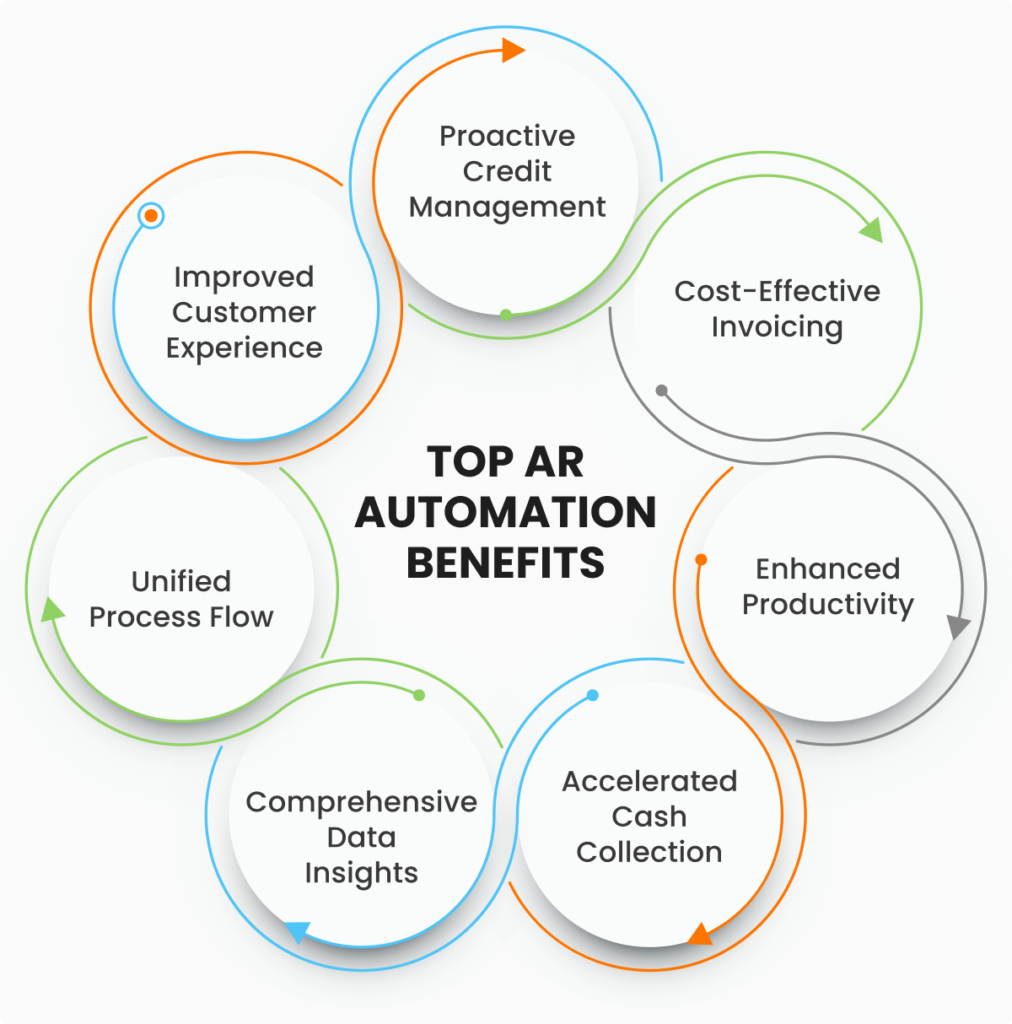

The above is basic information about the benefits of accounting outsourcing, but they are only the tip of the iceberg. Companies can benefit even more when their vendor of choice uses advanced accounts receivable automation solutions to further increase the value of their arrangement. Benefits of invoicing automation.

Many of the challenges that drive companies to outsource A/R can be effectively addressed with an ad management and automation platform. Some of the most popular use cases for A/R automation include:

Automating the invoicing process ensures the accuracy and timely preparation of invoices. Automated invoicing can also reduce errors and help businesses get paid faster.

By simplifying payment processing and enabling businesses to accept a variety of electronic payments, automation reduces manual labor and speeds up payment processing time.

Automation can also help with reminders and collections by sending automatic payment reminders and collection notices. This can help improve compliance and reduce offenses by improving customer interactions. Reporting and Analysis:

The best A/R automation platforms can provide real-time accounts receivable reporting and analytics, giving companies better visibility into their financial operations. This can help companies identify A/R collection trends and areas for improvement, supporting a stronger financial system across the board.

Contact us to learn more about the benefits of A/R collections management and automation and how our team can help you get more from your business.

Fix a meeting with our Accounts Receivable Outsourcing Company Now!

Let’s Build Your Business Together and pave the way for success, one balanced ledger at a time.”

Copyright © 2024 – Booksdr. Powered By Books DR.

Disclaimer: Books Dr is a team of accounting experts and Intuit Certified QuickBooks® ProAdvisors®. We’re here to help you with specific Intuit® products. You can purchase products and get customer service directly from Intuit. Just so you know, Books Dr isn’t the official representative for any of the logos, trademarks, or brand names associated with Intuit QuickBooks. Read More